ARK Invest Sells $2.5M in Grayscale GBTC Amid BTC Price Surge

ARK Invest is trimming its stake in the Grayscale Bitcoin Trust (GBTC) amid mounting speculation that the long-awaited approval of a spot bitcoin exchange-traded fund (ETF) in the U.S. could come soon.

According to a recent trade notification viewed by CoinTelegraph, the New York-based asset manager sold 100,739 shares in GBTC worth over $2.5 million from its ARK Next Generation Internet ETF (ARKW).

This marks ARK’s first reported GBTC transaction since last November when the firm added 450,272 GBTC shares valued at $4.5 million to the fund.

Also read: Polygon (MATIC) Price Prediction: October End 2023

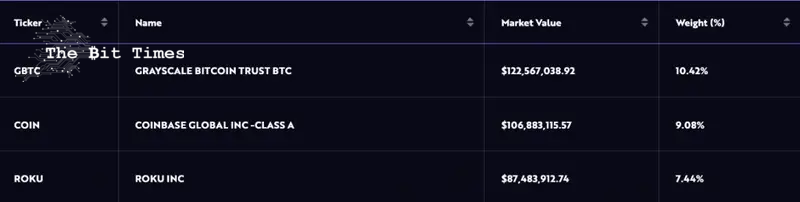

The latest sale reduces Ark Invest’s GBTC stake to 10.4%

The latest sale reduces Ark Invest’s Grayscale GBTC stake to around 10.4% of the ARKW portfolio’s total assets, down from roughly 12% previously. Even so, GBTC remains ARKW’s largest holding, followed by Coinbase and Roku shares.

ARK’s move comes as GBTC hit multi-month highs this week, surging above $24 for the first time since May 2022. Some analysts believe ARK is cutting its GBTC position in anticipation of a spot Bitcoin ETF receiving regulatory approval soon. Both ARK and Grayscale have filed proposals for spot Bitcoin ETFs this month after years of rejections by the SEC.

The long-running saga over a spot crypto ETF may finally be nearing its conclusion, given growing institutional adoption. SEC approval could open the floodgates to greater mainstream investment in bitcoin.

Comments

Post a Comment