Bitcoin Price Begins Run-Up To $35k – Here's Why

This bullish wave appears to be traversing the market, as Ethereum is up 1.3% to $1,876, XRP is up 2% to $7.1 while BNB is trading at $242 following 1.8% of 24-hour gains.

Bitcoin Price Ready to Tackle $30k Resistance

Bitcoin price is on the move to retest the seller congestion at $30,000. Its uptrend is grounded in the support established around $29,000 – an area that has been instrumental in preventing declines to $28,000 and subsequently $25,000.

The ongoing uptrend could be attributed to oversold conditions in lower timeframes – likely to result in a buy signal from the Moving Average Convergence Divergence (MACD) indicator.

That said, traders should be on the lookout for a potential bullish cross in the momentum indicator, especially on the daily chart, marked by the MACD line in blue crossing above the signal line in red.

Recommended Articles

The Relative Strength Index (RSI) will provide further assurance of the uptrend if it starts trending higher within the neutral area (30 – 70). Traders seeking exposure to long positions may want to wait until Bitcoin price sustains support above the 50-day Exponential Moving Average (EMA) (red) at $29,367.

A sustained break and hold above would amplify the buying pressure, with investors reaffirming their bullish projections for gains above $32,000 and eventually to $35,000.

According to Captain Faibik, a popular crypto analyst and trader, Bitcoin will likely “hit $32k first, and then we may witness a 15 – 20% correction in the coming weeks.”

The chart in the tweet below reveals that Bitcoin price recovery above $30,000 may slow down on approaching the stubborn resistance at $32,000, thus triggering a sell-off to $25,000.

I think $BTC will hit 32k first, and then We may Witness a 15-20% Correction in the Coming Weeks.

Share Your Thoughts 💭#Crypto #Bitcoin #BTC pic.twitter.com/Qni4cCBxLX

— Captain Faibik (@CryptoFaibik) July 27, 2023

Bitcoin Volume Dominance Drops – What Does This Mean?

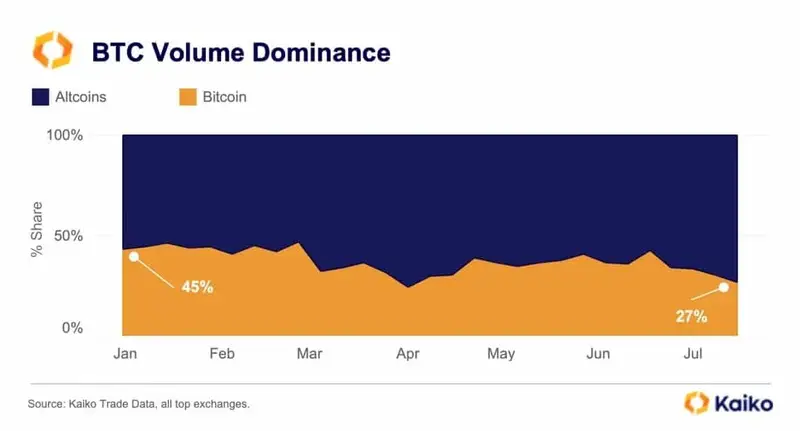

Bitcoin dominance volume has been on a long-standing downtrend, dropping by 8% since the beginning of July and 27% since April. The Ripple ruling saw a sudden shift in investor interest to altcoins, at the expense of the BTC dominance, a picture that has been reflected across 25 centralized exchanges.

Offshore exchanges were impacted the most by the drop in BTC trading activity. The Kaiko report says that this could be “partially due to a spike in South Korean altcoin volume.”

“Since the start of 2023, BTC dominance has fallen by 20%. On U.S. exchanges, altcoins have also gained traction over the past month, which suggests the regulatory crackdown has not yet dampened demand,” the Kaiko report states.

On the other hand, altcoin liquidity “measured by 1% market depth,” has recorded a minor uptick since the beginning of July. Market depth for the top 10 altcoins shot up by approximately $20 million.

Since no one can tell how long this drop in BTC dominance is likely to last, it would be prudent for traders to prepare for a probable retracement to $28,000, while not ruling out further declines to $25,000.

Related Articles

- Pro Crypto BlackRock Inks A Joint Venture With Indian Giant Jio

- US Prosecutors Drop Charges on SBF For Illegal Campaign Contribution

- Crypto Crash Or Bull Run? FED Hikes Interest Rates Again